Understanding the Value Beyond Adornment

Investing in jewelry

Is not just about adding to your fashion collection; it’s about making strategic decisions that could yield financial benefits in the long run. Jewelry as an investment involves understanding market trends, recognizing quality craftsmanship, and knowing the intrinsic value of materials used. This blog explores the essentials of investing in jewelry, providing insights to help you make informed decisions.

Jewelry as Investment: Understanding the Value Beyond Adornment

Investing in jewelry goes beyond purchasing beautiful objects—it involves acquiring assets that can appreciate in value over time. High-quality pieces made from precious metals and gemstones not only retain their worth but can also increase due to their rarity and demand.

Jewelry as Investment: Understanding the Value Beyond Adornment

The first step in investing in jewelry is to assess the quality and authenticity of the pieces. It’s essential to:

- Understand the hallmarking of precious metals.

- Recognize the characteristics of genuine gemstones.

- Evaluate craftsmanship and the reputation of the maker or brand. These factors significantly influence the resale value and investment potential of jewelry.

Jewelry as Investment: Understanding the Value Beyond Adornment

Keeping an eye on market trends is crucial for jewelry investors. Historical performance, fashion trends, and economic factors can all influence the appreciation of jewelry pieces. For instance, vintage pieces from renowned designers or brands often gain value over time due to their limited availability and historical significance.

Jewelry as Investment: Understanding the Value Beyond Adornment

Like any investment, purchasing jewelry comes with its risks. The fluctuating prices of metals and gemstones, the liquidity of certain jewelry pieces, and the potential for depreciation all play a role. Investors should diversify their jewelry investments and consider insurance to mitigate these risks.

Jewelry as Investment: Understanding the Value Beyond Adornment

Developing a long-term investment strategy is key to success. Factors to consider include:

- Buying during times of economic downturn when precious metal prices might be lower.

- Selling when market demand is high, or when particular styles or pieces come back into fashion. Timing the market can significantly impact the return on investment.

Jewelry as a Sustainable Investment

Jewelry as Investment

Investing in jewelry requires patience, knowledge, and an appreciation for the art of jewelry making. With the right approach, jewelry can be a worthwhile addition to your investment portfolio, offering both aesthetic enjoyment and potential financial gain. Whether for personal pleasure or investment purposes, understanding the intrinsic and market-driven factors that influence jewelry’s value will equip you with the tools to make savvy purchasing decisions.

By partnering with a trusted name like Bamina Jewelry, known for its commitment to quality and timeless designs, you position yourself to not only enjoy the beauty of these items but also to potentially secure financial benefits in the future. Bamina Jewelry offers pieces that are not only beautiful but are crafted to stand the test of time, making them perfect candidates for investment. Treating jewelry purchases with the same consideration as other investments opens up the opportunity to enjoy aesthetic pleasures while also enhancing your financial portfolio through tangible assets.

Create Your Design

Related Posts

2026 Color, Texture, and Finish Trends in Jewelry Design

Jewelry design evolves with culture, emotion, and lifestyle. In 2026, designers move toward balance, depth, and tactile expression. 2026 Jewelry Trends show a clear shift away from sharp contrasts and heavy decoration toward refined color, thoughtful texture, and intentional finishes. These elements work together to create jewelry that feels calm, modern, and wearable.

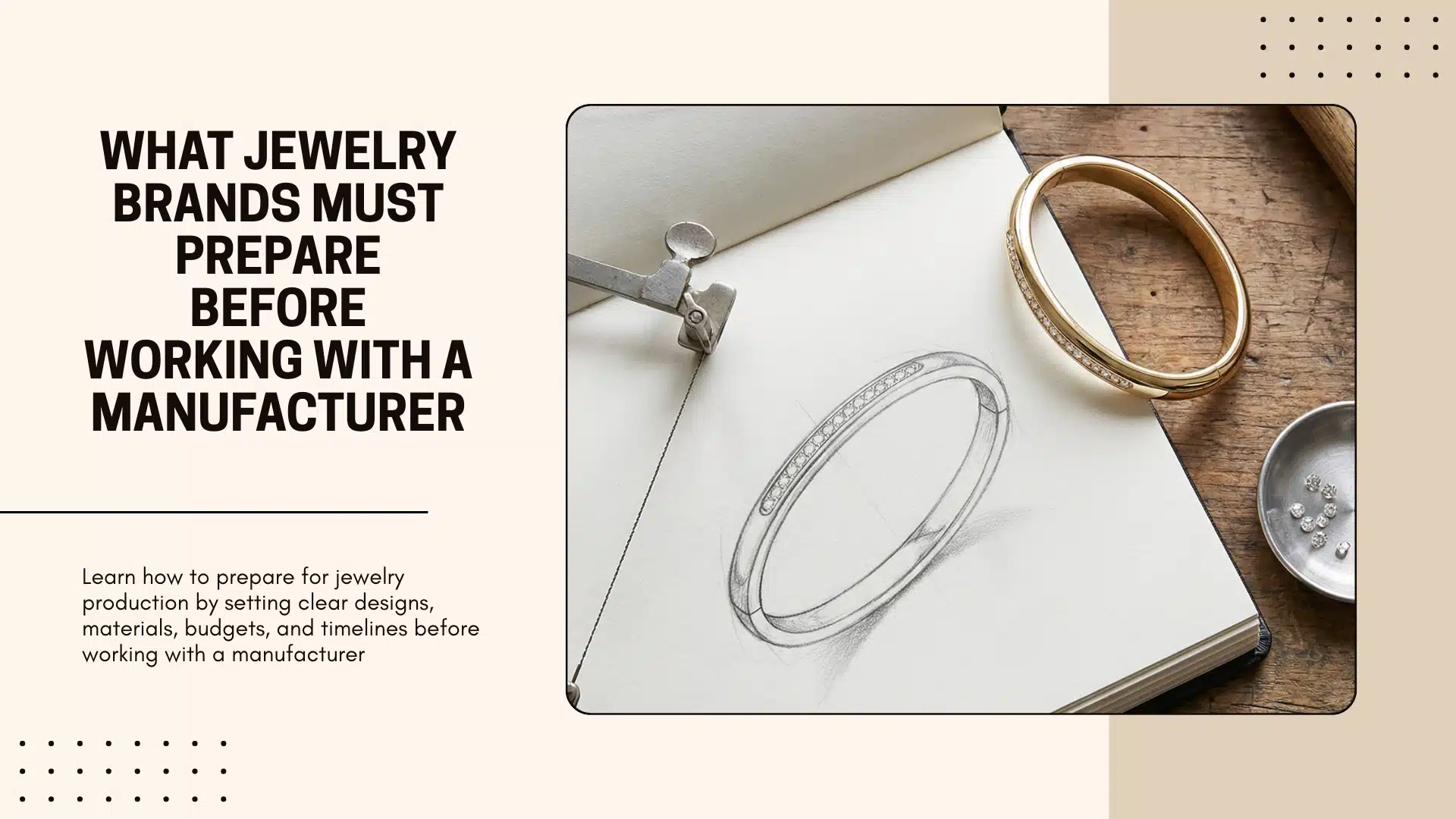

What Jewelry Brands Must Prepare Before Working with a Manufacturer

Working with a jewelry manufacturer can accelerate brand growth, but preparation determines results. Many delays and misunderstandings come from missing information rather than poor execution. Understanding how to prepare for jewelry production helps brands move confidently from idea to finished product. Strong preparation saves time, controls cost, and builds trust with manufacturing partners.

Gold, Silver, and Gemstones: Which Jewelry Holds Its Value Best?

Many people buy jewelry for style or emotion. However, some also think about long-term value. This raises an important question: which jewelry truly holds its worth over time? For those starting out, Jewelry as Investment for Beginners offers a useful framework. Understanding materials, market behavior, and craftsmanship helps buyers make smarter choices without chasing trends.

Benefits of AI-Generated Jewelry Design for Brands and Startups

Jewelry design has always balanced creativity and precision. Today, technology adds a new layer to this balance. Artificial intelligence now supports designers in exploring ideas faster and smarter. The Benefits of AI-Generated Jewelry Design for Brands appear most clearly for startups and growing labels that need speed, flexibility, and cost control without losing creativity.

Birthstones, Engravings, and Symbols: Meaningful Details for Custom Jewellery Gifts

Jewellery becomes powerful when it tells a story. A simple ring or pendant can hold deep emotion when it includes personal elements. This is why Meaningful Details for Custom Jewellery Gifts matter so much. Birthstones, engravings, and symbols turn beautiful objects into personal keepsakes. These small choices often define the emotional value of the piece.